Ira rmd calculator 2021

Ad Whats Your Required Minimum Distribution From Your Retirement Accounts. 1 Use FINRAsRequired Minimum Distribution Calculator to calculate your current years RMD.

Required Distributions On Inherited Retirement Accounts Reduced In 2022 Putnam Wealth Management

2022 Retirement RMD Calculator Important.

. Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. RMD amounts depend on various factors such as the decedents age at death the year of death the type of. If you want to simply take your.

Get a quick estimate of how much. How is my RMD calculated. Ad Manage Your Retirement Savings Through Fidelitys Range of Options for Your IRA.

Discover Fidelitys Range of IRA Investment Options Exceptional Service. Lets say you celebrated your 72nd birthday on July 4 2021. Ad Learn more about Fisher Investments advice regarding IRAs taxable income in retirement.

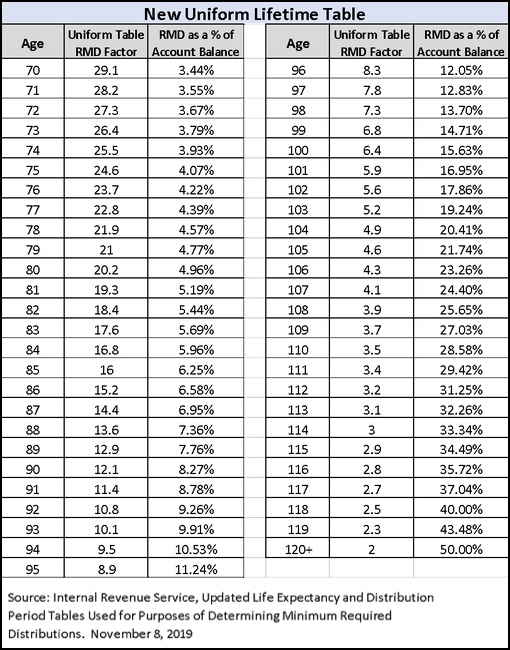

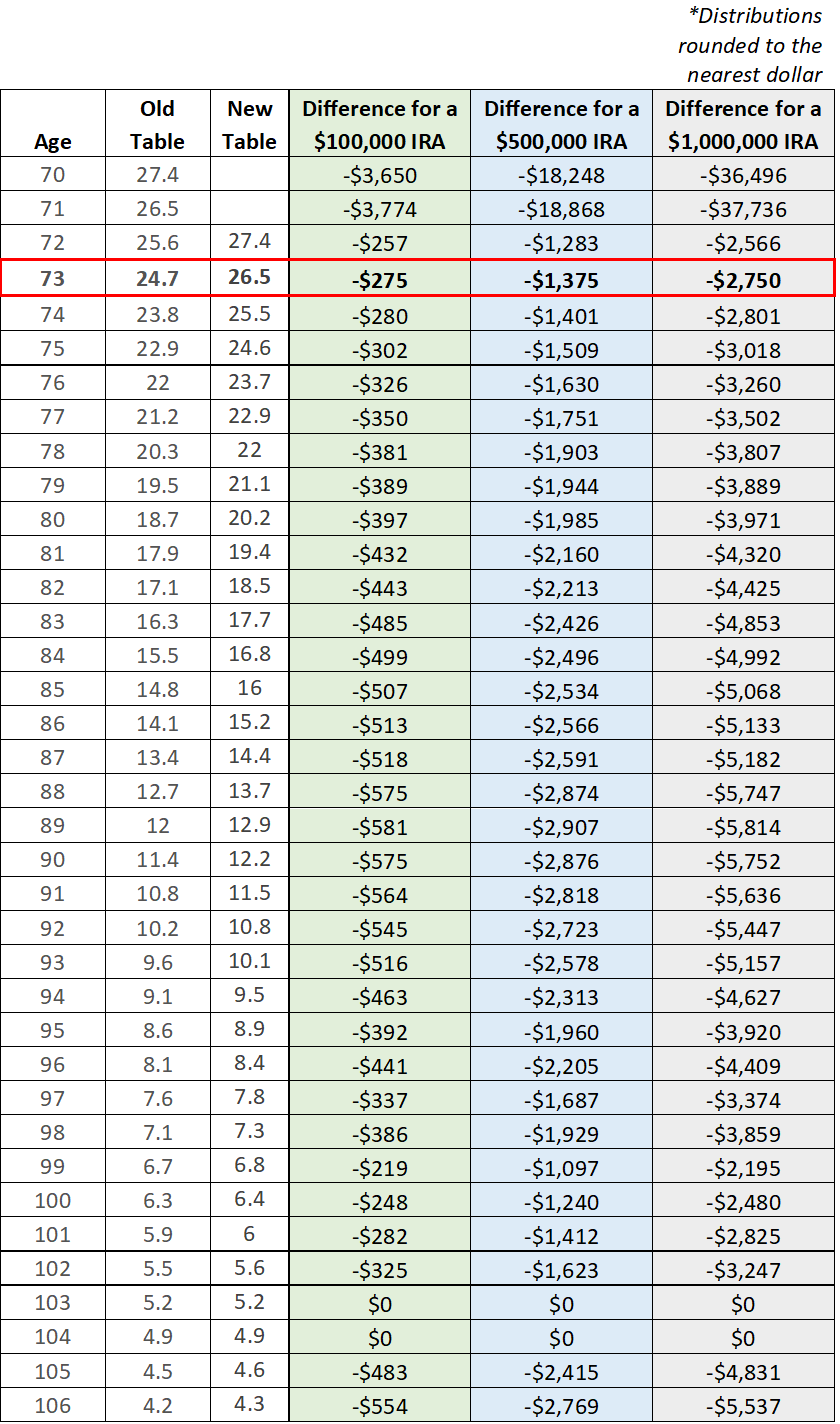

The IRS has published new Life Expectancy figures effective 112022. Whatever Your Investing Goals Are We Have the Tools to Get You Started. Determine your required retirement account withdrawals after age 72 Retirement Income Calculator.

Run the numbers to find out. Maya inherited an IRA from her mother. IRA Required Minimum Distribution RMD Table for 2022.

Use one of these worksheets to calculate your Required Minimum Distribution from your own IRAs including SEP IRAs and SIMPLE IRAs. If your spouse1 is the sole beneficiary of your IRA and theyre more than 10 years younger than you use this worksheet to calculate this years required withdrawal. The SECURE Act of 2019 raised the age for taking RMDs from 70 ½ to 72 for.

See When How Much You Need To Begin Withdrawing From Your Retirement Savings Each Year. These amounts are often called required minimum distributions RMDs. Determine beneficiarys age at year-end following year of owners.

Ad Manage Your Retirement Savings Through Fidelitys Range of Options for Your IRA. Use this worksheet for 2021. 401k Save the Max Calculator.

Its equal to 50 percent of the amount you were supposed to withdraw. The age for withdrawing from retirement accounts was increased in 2020 to 72 from 705. Understand What is RMD and Why You Should Care About It.

Determine the required distributions from an inherited IRA. As part of the bipartisan COVID-19 stimulus bill Congress suspended required minimum distributions for 401k and IRA plans for 2020. To calculate your required minimum distribution simply divide the year-end value of your IRA or retirement account by the distribution period value that matches your age on.

Required Minimum Distribution Calculator Avoid stiff penalties for taking out too little from tax-deferred retirement plans. If youve inherited an IRA depending on your beneficiary classification you may be required to take annual withdrawalsalso known as required. RMD Tables 2022 - 2023.

When you are the beneficiary of a retirement plan specific IRS rules regulate the minimum withdrawals you must take. Required Minimum Distribution RMD Calculator. This calculator has been updated to reflect the new.

Use this worksheet to figure this years required withdrawal from your non-inherited traditional IRA UNLESS your spouse 1 is the sole beneficiary of your IRA. Divide 500000 by 255 to get your. Account balance as of December 31 2021.

Your life expectancy factor is taken from the IRS. Calculate your earnings and more. Discover Fidelitys Range of IRA Investment Options Exceptional Service.

Once the factor is determined it can be divided into the December 31 2020 balance to get the RMD amount for 2021. The rmd is calculated using the uniform life table and the deceased owners age 76 at death in the year of the ira holders death in 2022. 401k and IRA Required Minimum Distribution Calculator.

Determine your Required Minimum Distribution RMD from a traditional 401k or IRA. Use this calculator to determine your required minimum distributions RMD from a traditional IRA. Paying taxes on early distributions from your IRA could be costly to your retirement.

Use younger of 1 beneficiarys age or 2 owners age at birthday in year of death. Distribute using Table I. The Required Minimum Distribution shortly known as RMD is the minimum amount a retiree needs to withdraw from their account every year after.

Ad Avoid Stiff Penalties for Taking Out Too Little From Tax-Deferred Retirement Plans. Use this worksheet for 2021.

Required Minimum Distributions Update 2021 Fcmm Benefits Retirement

Rmd Table Rules Requirements By Account Type

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Rmd Table Rules Requirements By Account Type

Sjcomeup Com Rmd Distribution Table

Required Minimum Distribution Calculator

What Do The New Irs Life Expectancy Tables Mean To You Glassman Wealth Services

New Tables Are Available For Calculating Required Minimum Distributions Rmds In 2022 Julie Jason

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

10 Ira Minimum Distribution Calculator Templates In Pdf Free Premium Templates

Required Minimum Distributions Tax Diversification

Required Minimum Distribution Rules Sensible Money

Where Are Those New Rmd Tables For 2022

How Recent Changes To Required Minimum Distribution Rules May Affect Future Value Tsp Accounts

Irs Proposes Updated Rmd Life Expectancy Tables For 2021 Life Expectancy Proposal Irs

Required Minimum Distributions Rules Heintzelman Accounting Services

Sjcomeup Com Rmd Distribution Table